One of the essential skills to learn in your 20s is how to handle money smartly. Everyone knows it’s important to earn money, but how do you manage it without ending up broke by 30 or 40?

I remember when I got my first-ever paycheck as an adult; That money felt like a lot, and I felt like I needed to spend it right away. After some weeks, I realised with horror that I was broke and that I should have saved some money for emergencies. So I have slowly learnt how to take care of my money, and here is what I have been trying. Here is my exact method to manage your money to not make the same beginner mistakes I did.

1-Audit your finances

First things first: If you wanna make a difference in your finances, you need to know and understand where you stand.

Take a hard look at your money habits.

Review your transactions and look for where you spend your money regularly. Most banks have a phone app you can use to verify; if not, you can check your monthly bank statements you receive either by mail or email.

Now you’re gonna try to understand where you spend most of your money. At this point, you don’t have to do anything yet; note your observations.

- Identify spending leaks

Do you still have that gym membership you had since the beginning of the year for your New Year’s resolution? Are there any more subscriptions you don’t use anymore but keep paying for? Impulse purchases? Small expenses add up.

This is where you are gonna assess what is working for you and what needs to be changed.

Rank what actually matters.

Reassessing your priorities gives you a better idea of what you need to focus on at the moment. That could be paying off your college tuition, a mortgage, car payments, medical bills or everyday expenses . This is what you’re gonna spend most of your time and money on. This priority list can change over time. Tuition may be your top priority now, but later it might be saving for a house or a car.

Now that you know where your money’s going and what to prioritise, it’s time to put a plan in action.

2-Budget everything

It’s pretty easy to get lost in the rush and just spend all my money without realising. We got bills., things we need and the money can fly away.

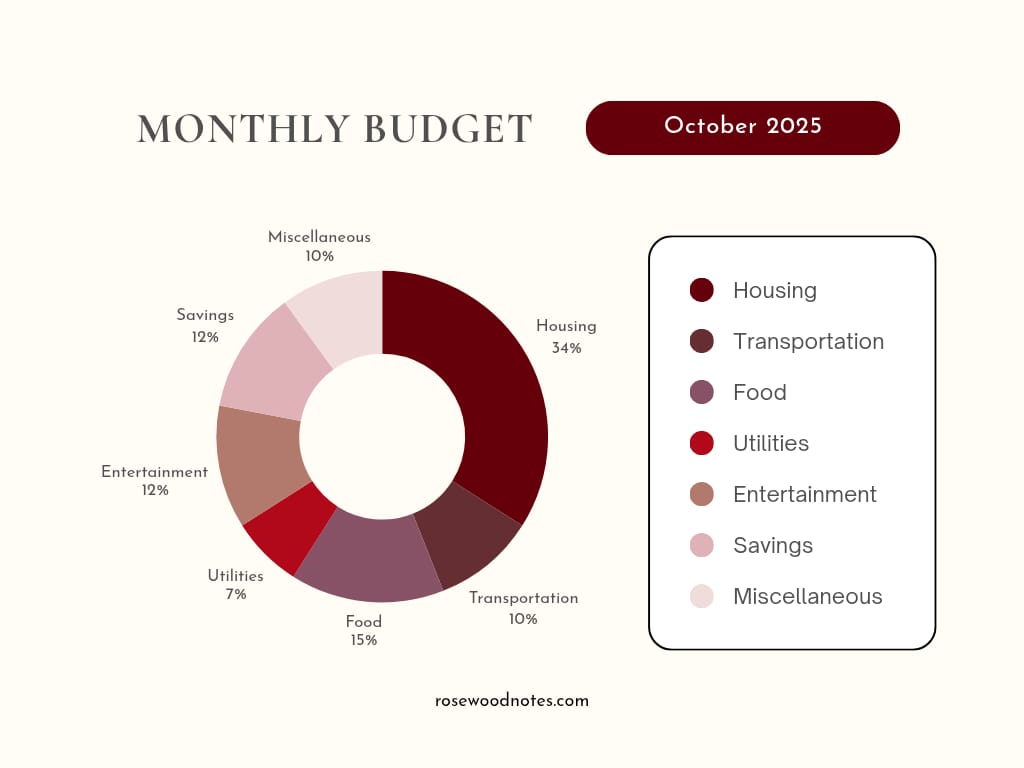

What to include in your budget?

- Your earnings

Knowing exactly how much money you earn every month is a crucial part, as it is what you’re gonna be working with. You need to list all your income sources ( your paychecks, side gigs, whatever)

- Bills

List every monthly expense. Think Groceries, rent, phone, gas, electricity, subscription, etc.

Now, for example, let’s say you make 2k a month. Yeah, I know that’s low, but stay with me.

Once you have that information, you will divide each dollar purposefully: bills first, then savings, then fun money, and finally any debt repayment.

You can do it on a spreadsheet in Excel or write it down in a notebook, on your phone note app, whatever is most convenient. You can also download an app to keep track of all that digitally.

Personally, I use Rocket Money because it tracks my transactions and tells me where my money goes every month. I can also make a budget, check my credit, check my subscriptions, and get reminders to pay my bills on time.

The goal is to never guess where your money is going and always have a clear plan for each dollar.

3-Save as much as you can

You never know when you might need a car repair, a flight home, or a doctor’s visit, and having a financial cushion keeps you from stressing or going into debt.

Now, how much money should you save? There isn’t a specific amount to save. It all depends on how much money you earn. But anything around 20% to 30% of your paycheck is a great place to start.

Sometimes it’s fine to take care of urgent matters and not save anything. The most important thing is to save what you can and be more strategic with your money.

Start a high-yield savings account.

What is a high-yield savings account?

A savings account that pays you more interest than a regular one for keeping your savings there.

Most regular savings accounts earn almost nothing (sometimes less than 0.1%). High-yield ones can earn 10–20 times more, depending on the bank and the economy. That means your money grows faster without you doing anything extra.

If you have $1,000 in a regular savings account earning 0.1% interest, you’d make only $1 in a year. If you put that same $1,000 in a high-yield account earning 4.0%, you’d make around $40 in a year by letting it sit there.

4-Spend smart

Choose the most affordable option whenever you can

Compare prices, look for deals, and avoid impulse buys.

Know when it’s ok to pay more for good quality.

Yes, I know what I said earlier. But unfortunately, the cheapest option might not be the best one all the time.

Now picture this: you buy a cardigan made of polyester and other synthetic fibres for $50. After a couple of washes, it’s gonna be frumpy and ugly, and eventually you’ll get rid of it.

Now, let’s suppose you buy another cardigan made of cotton or other natural fibres, and that cardigan is $200. That price might be higher than buying a polyester one, but this cardigan is gonna last longer and look good for a good period of time. The key is finding the balance with affordable options and still being smart enough to make decisions that will affect you in the long run.

Prioritise your needs over your wants.

Why? Because wants are temporary, but needs sustain your life and financial stability.

Now, here are the questions to ask yourself before you buy something:

1- Do you want it?

2-Do you NEED it?

Bonus: Can you afford it right now?

5- Understand credit

Many people think of credit cards as free money.

But let’s be serious, credit cards are what they are: credits. Money that is available to BORROW for a period of time and must be returned imperatively.

When it comes to building credit, here are three things to keep in mind:

The amount to spend/borrow every month

Let’s say you have a credit limit of $800. The amount safe to spend is 30% of $800, hence $240. Honestly, I think good to keep that amount to 10% to avoid overspending.

Your statement closing date

Your statement closing date is the day your credit card company adds up what you spent for the month and sends that number to the credit bureaus.

But here is my personal advice: Pay off your balance before your statement closing date so your reported utilisation is low. This will signal that you’re a good borrower, and your credit score will go up slowly but surely.

The date to completely pay off your balance

Pay your balance in full every month to avoid interest and maintain a healthy credit score.

Where to get those three pieces of information? Check your credit card statements, your online banking app, or call your credit card company; they’ll tell you.

These are 3 important things to remember to build good credit.

6- Learn to live within your means.

One of the traps most people my age fall into is living above their means, trying to impress other people. New phones, brand new expensive cars, etc

Especially when they see other people their age or younger travelling around the world for an unfathomable amount of money.

Here is a little secret: most people who seem to have it all are just living paycheck to paycheck or are straight up in 4 to 6 figures worth of debt.

There is no excuse to take on unnecessary debt.

Living within your means doesn’t mean you cannot have fun. But sometimes it means turning off the AC, wearing an extra sweater, or cooking at home instead of ordering takeout. It means making good financial decisions for your future.

7- Have fun, responsibility and smartly

Yes, I just told you to be careful with money, but that doesn’t mean you can’t enjoy yourself.

How to have fun while managing your money responsibly? Budget a little fun money. Go to a cheap concert, try a free class, or treat yourself occasionally. The trick is to enjoy life without wrecking your bank account.

Wrapping up

I wrote this guide, but honestly, I am still learning how to manage money and am still building good habits, making errors and learning from them. Yes, I do have a pair of shoes I bought last year that are still in the box. It was an impulse buy, and I completely forgot I had it until recently.

At the end of the day, what matters is building awareness, making small improvements, and being consistent. Money isn’t everything, but being smart with it will make your life a lot less stressful and more fun in the long run.

Do you know any more ideas to track your finances? What is your favourite money app to use? I’d love to hear from you.

‘til next time.